income tax plus self employment tax

Self-employment tax is 153 of. However the Social Security portion may only apply to a part of your business.

Schedule Se And 1040 Year End Self Employment Tax Stripe Help Support

Self-employment tax consists of 124 going to Social Security and 29 going to Medicare.

. This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. That rate is the sum of a 124 Social Security tax and a 29 Medicare tax on net earnings. Well here it is.

The rate consists of two parts. In 2022 income up to 147000 is subject to the 124 tax paid for the Social Security portion of self-employment taxes FICA. The standard rate is 153 which includes a 124 Social.

That 153 rate is comprised of. You pay 153 for 2013 SE tax on 9235 of. You must figure your business taxes for the year including income expenses tax.

Ad Free Prep Print E-File Start Your Tax Filing Today. You must pay SE tax and file IRS Form 1040 Schedule SE Self-Employment Tax if either of the following applies. You must pay self-employment tax if you had at least 400 of net income that didnt already have taxes withheld from it by an employer.

SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves. Self-Employment Tax Definition. The self-employment tax rate is 153 of your net profit or loss from your business for a year.

Discover Helpful Information and Resources on Taxes From AARP. Self-employment income is earned from carrying on a trade or business as a sole proprietor an independent contractor or some form of partnership. The Social Security portion has a limit on how much of your income is taxed currently 142800 or.

For 2019 the SE tax rate is 153 on the first 132900 of net SE income. Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020. Self-employment tax is levied on self-employment income and covers Social Security and Medicare taxes.

As noted the self-employment tax rate is 153 of net earnings. For 2021 employees pay 765 percent of their income in Social Security and Medicare taxes with their employers making an additional payment of 765 percent. Discover Important Information About Managing Your Taxes.

The self-employment tax rate for 2021-2022. Here are some examples of how much self-employment tax you may need to pay depending on your earnings. The self-employment tax comprises Medicare and Social Security taxes.

On a salary of 25000 you would pay self-employment tax of 3825. Your net earnings from self-employment were 400 or more. To be considered a trade.

It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. The Self-Employed Contributions Act SECA is the name of the tax on self-employment. Ad Our clients typically receive refunds 7061 greater than the national average.

Get a personalized recommendation tailored to your state and industry. Ad Are You Suddenly Self-Employed. Your employment wages and tips should have a 62 deduction.

Employed workers pay half of their Social Security and Medicare taxes. Get a personalized recommendation tailored to your state and industry. The self-employment tax rate is 153 with 124 for Social Security and 29 for Medicare.

The calculator took one of these for you known as the self employment deduction. Pays for itself TurboTax Self-Employed. The self-employment tax rate is 153.

Ad Our clients typically receive refunds 7061 greater than the national average. In 1935 the federal government passed the Federal Insurance Contribution Act FICA which established taxes to help fund Social Security. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

If you earned more than 400 working for yourself last year the IRS considers you a self-employed individual. To calculate your income tax were going to assume that youre a single filer with no additional tax deductions or credits besides the self-employment tax deduction. This means that along with filing an annual return youll need to pay.

Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. Develop A Tracking System. Adjusted Gross Income AGI is your net income minus above the line deductions.

Self-employment tax is not. The self-employment tax rate is 153 of net earnings. If youre used to the normal W2 structure switching to self-employment taxes comes with a large learning curve.

That rate is the sum of a 124 Social Security tax and a 29. According to the IRS self-employed individuals are required to pay self. 124 for the Social Security tax component of the SE tax plus.

The Self-Employment Tax. This is your total income subject to self-employment taxes.

Self Employed Health Insurance Deduction Healthinsurance Org

What Is Schedule Se The Tax Form For The Self Employed

What Is Self Employment Tax Paycheckcity

10 Of The Most Common Self Employment Tax Deductions For 2021

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Are Self Employment Taxes Turbotax Support Video Youtube

Organize Small Business Taxes Plus Free Printables Small Business Tax Business Tax Business Finance

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Missouri Income Tax Rate And Brackets H R Block

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

7 Self Employment Tax Forms For Home Business Owners Tax Forms Business Tax Self Employment

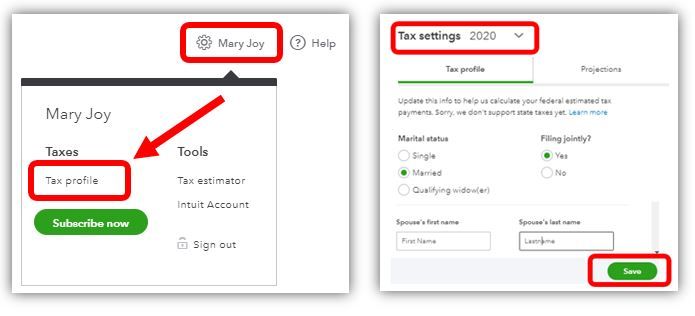

Creating An S Corporation Entity Can Reduce Self Employment Tax Tax Pro Center Intuit

Self Employed Federal Income Taxes Turbotax Tax Tips Videos

Self Employed Turbo Tax Bundle

Self Employed Less Than A Year How To Do Your Taxes Turbotax Tax Tips Videos

Schedule C Income Mortgagemark Com

Self Employment Tax What It Is How It Works And How You Can Save Ey Us

Self Employment Tax Tax Guide 1040 Com File Your Taxes Online